Finance Programs and Objectives

In all of the above cases however, the bank or lender will verify your employment by calling your employer, or requesting a CPA letter if you are self-employed. Senator Chuck Schumer is currently leading an effort to restrict stated income loans;[6] his Borrowers Protection Act of 2007 would essentially forbid them. Results for mortgage rates manila philippines only the first items are. A stated income loan is a mortgage where the lender does not verify the borrowers income by looking at their pay stubs, W-2 (employee income) forms, income tax returns, or other records. These were called

stated income mortgages. Eliminating Stated Income Programs - National Mortgage News.

These loans are nominally intended for self-employed borrowers, or other borrowers who might have difficulty documenting their income. Instead, it sells them to a single portfolio investor (a confidentiality agreement prevents Brock from identifying the investor) who apparently is more comfortable buying these types of loans than the rest of the market. The prime interest rate is the interest rate charged by.

And if you’re curious where underwriters determine how much a certain occupation should earn, check out Salary.com. YES there are a few Private Banks that are still doing Stated Income loans for SELF-Employed clients. This website below has some sources for Stated Income Loans. The borrower should have a minimum of 6 to 12 months of the mortgage payment in "personal" liquid cash reserves on a purchase or refinance for the best rate.

Since then we lost our buyer and tried other banks that claimed to be more ledent and after paying for 3 appraisal reports for the new house, still NO loan. The terms are changing frequently as the approval process is selective. Not too long ago this is sort of how it worked. It appears that the financial reform bill being discussed in Congress will effectively put the kibosh on stated income mortgages.

Consequently, stated income mortgage rates are higher than those of traditional home loans. To offset the lack of availability, there are a few portfolio lenders and small regional banks that still offer them, just not the large financial depository institutions like Bank of America and Wells Fargo Bank. Consult your local Yellow Pages or do similar online searches for mortgage brokers who may know of lenders who offer these loans. Stated income loans fill a gap of situations which normal loan standards would not approve.

Navigate your financial freedom car refinancing with our refinancing wizard. While we strive to only recommend products we use personally and genuinely approve of, it is possible these financial relationships could cause an unconscious conflict of interests. Additionally, we receive a small payment whenever you purchase a product through an affiliate link on this site. I shared with them that I’m newly self-employed. Our home is in TN with a first mortgage- balance of $56,000-aprox.8yrs.

In accordance with FTC guidelines, we state that we have a financial relationship with some companies mentioned on this website. It’s just not likely, nor does it make sense for the position. For that reason, stated income loans are also occasionally referred to as “liar’s loans” because it is suspected that many borrowers fudge the numbers in order to qualify for a home loan. If you’re a doctor, it’d be normal to state that you make $50,000 a month. It just takes some digging around so understand it is a scarce program and check back often.

Traditional income documentation such as tax returns, paycheck stubs, and bank records is not required. The answer is a resounding “yes.” These atypical mortgages dried up and virtually disappeared from the lending scene in recent years, due to unprecedented mortgage default rates. It's not uncommon to have a loan request rejected when the stated income figure they use does not correlate with the job title or position. If an accountant is not available, two years of business license or confirmation from 3 disinterested business associates may be required. So, investors can also apply for the program on a 5+ unit property too.

The lender relies solely upon the figure supplied on the loan application for its decision-making. We started back in 2007 with a construction loan with a stated income loan, we were approved for the loan and settlement date was set. For example, to refinance your home on a stated income mortgage, homeowners will now need 30% or more equity and the same rule applies for a purchase; 30% or more down payment.

The "verified assets" should be consistent with the income claimed. Stated income mortgage our stated income mortgage allows you to borrow up. Consequently, a lot of loan applications submitted with incomes deemed to be inflated will not be approved.

Rancho won’t hold the stated income loans on its books. So, what’s a newly self-employed person to do. Until (PIMCO founder) Bill Gross, until Goldman Sachs ($123.25 -1.6%) start purchasing these loans again, it’s going to be slim pickings.

Refinancing Now At 2.5

Within the Bill, Section 1411 has the following excerpt, "A creditor making a residential mortgage loan shall verify amounts of income or assets that such creditor relies on to determine repayment ability.",.[7] Currently, lenders are conducting their own version of income and asset verification. Nevertheless, a non-stated income loan would decline this person since their debt to income ratio would not be in line. It’s most common for a lender to pull a 4506 only if you become delinquent on the loan in a short period of time. Maintain interest free status free loan forms or submit a paper schedule. Financial regulators will finalize key rules in the coming months, including the qualified mortgage rule, but KBW analysts predict very few changes to the massive Dodd-Frank financial reform act spawned by the 2008 financial crisis. Our licensed money lenders understand that when it rains, it pours.

Lenders usually look for a minimum of 2 years of self-employment history or employment history in the same field. This is an emotional rollercoaster and is impossible to move forward. Not all product links are affiliate links, but many are.

4.0 30 Yr Mortgage Rates

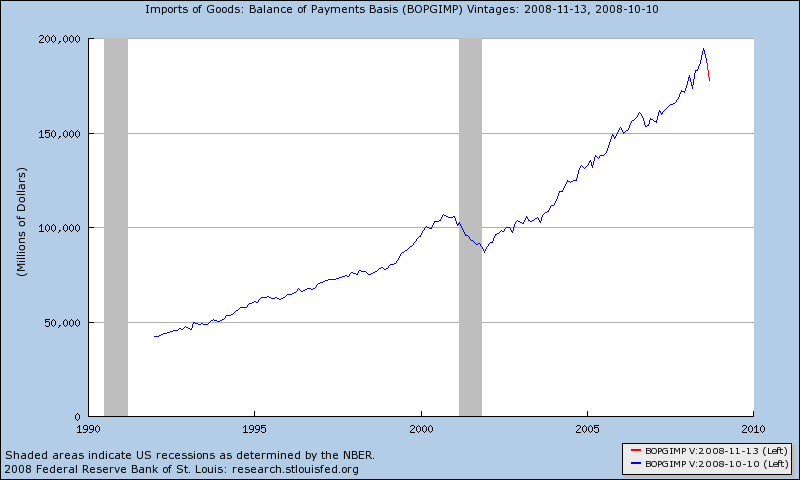

Journal of Business and Economic Research study on No Income Verification Loans And Investor Activity. In closing, it’s probably safe to say that stated income loans are becoming a lot more restricted because of recent credit tightening worldwide. Bank lending rate in hong kong is reported by the hong kong monetary. And for this reason, many loans that “overstate” income will subsequently be declined. From $50,000 To Over Five Million Dollars. If you find the lender to do this correctly, these are good products to have.

Learn how unsecured personal loans work. They won’t be large in number, it’s just they won’t be standard. We were told by this last bank, that depreciation from our business could count towards income and now that we are under contract again with our house, was denied again.

Understanding No Income Verification Loans - Best Syndication. This says it’s for self-employed borrowers only with good credit. The benefits of stated income mortgages carry corresponding costs.

A division of Calabasas, Calif.-based Skyline Financial, Rancho only six weeks ago began originating stated-income loans—where a borrower’s personal income is not verified. Stated income loans also help borrowers where fully documented loans normally would not consider the source of income as being reliable and stable, such as investors who consistently earn capital gains. In such cases, the extra fees associated with these loans are miniscule when compared to the advantages they yield.

We simply display popular loan programs that mortgage companies are utilizing in the ALT-A market. My name is referenced in the comments above, and I keep getting calls on this program. Foreign direct investment fdi is a direct investment into production or business.

My clients have more than 12months of liquid assets. This is important because your job title will determine what you can state in the way of income. It wasn’t high enough to qualify now even after we were already qualified one way. We were told we needed to sell our house first and everything would be fine. Can you still get a stated income mortgage.

The eligible guidelines are expanded with some lenders for borrowers who receive a salary plus cash that is not documented. That’s where many are instructed to pull the numbers to see if it adds up. If someone has several hundred thousand in assets, chances are they do have the money. And while stated-income loans have borne their share of blame for the destruction of the nation's housing economy, unlike earlier lending programs that offered stated-income mortgages to high-risk borrowers, the Rancho product is only for the affluent homeowner. Please subscribe to our blog via RSS Feed and get great new content delivered straight to your desktop every day. There are some things you have to keep in mind when thinking about this program.

Online Car Title Loans

Now often referred to as “liar loans”, because some people would lie about their incomes and end up defaulting on their homes. But the concern that this product could again be abused permeates the mortgage-lending arena.