Finance Programs and Objectives

As shown in the chart, at the time of projected trust fund exhaustion in 2037, continuing tax revenue is expected to be sufficient to cover 76 percent of the currently scheduled benefits. The intermediate projections of the 2009 Trustees Report indicate that if we wait to take action until the combined OASDI trust fund becomes exhausted in 2037, benefit reductions of around 25 percent or payroll tax increases of around one-third (a 4 percent increase in addition to the current 12.4 percent rate) will be required. No credit check mortgage lenders free yearly credit report application derogatory. Thus, individual reform provisions can be more fully understood by considering both their effect on the 75-year actuarial balance as a whole and their specific effect on the annual balance for the 75th year. Before 1900, the probability that a newborn would

social security future survive to age 5 or 10 was far below 100 percent. Finally, as Treasury debt securities (trust fund assets) are redeemed in the future, they will just be replaced with public debt.

It is for this reason that past major reforms of the Social Security program, specifically those in 1977 and 1983, occurred as the trust fund asset levels were approaching exhaustion. For these projections, many economic, demographic, and disability-related parameters are allowed to vary randomly through time, creating 5,000 separate possible projection scenarios. Although the financial status of the Social Security program is most often considered on a combined basis, as though there were just one trust fund, there are in fact two separate trust funds—one for the OASI program and the other for the DI program.

Building Cost Per Square Foot

In 1994, the Congress acted to reallocate a portion of the combined OASDI payroll tax rate from the OASI program to the DI program, in order to avert near-term trust fund exhaustion for the DI program. Trust fund levels expressed as a percent of annual program cost were presented earlier for the three alternative projections. Thus, solvency is not effectively extended to any substantial degree by this provision. Exhaustion of trust fund assets is projected to occur under the intermediate assumptions because program cost will begin to exceed the tax revenues dedicated to the trust funds in the future, requiring increasing amounts of net redemptions from the trust funds. As a result of changes to Social Security enacted in 1983, benefits are now expected to be payable in full on a timely basis until 2037, when the trust fund reserves are projected to become exhausted.1 At the point where the reserves are used up, continuing taxes are expected to be enough to pay 76 percent of scheduled benefits. Solvency for the Social Security program is defined as the ability of the trust funds at any point in time to pay the full scheduled benefits in the law on a timely basis.

In addition, shifts in these parameters have not been as dramatic as the change in birth rates. But the permanent shift in the age distribution between 2010 and 2030 because of lower birth rates remains the dominant factor for the increased Social Security program cost over the next 75 years. We specialize in cash loans, bad credit car loans and personal loans.

The permanence of this shift was not caused by the existence of the baby boom generation; instead, the permanent shift was caused by the substantial and apparently permanent drop in birth rates that followed the baby boom births. It also allows changes to be phased in on a gradual basis so that there will not be sharp breaks in the benefit or tax levels faced by succeeding generations in the future. But it is up to each generation to come to a consensus on the tax levels it is willing to pay and the benefit levels it wants to receive. President obama s proposal to trim future medicare and social security benefits. Sustainability in both senses can be reasonably addressed by considering the share of the total output of the economy (GDP) that will be needed to support the benefits provided by the program.

Hong Kong Company

Historically, a single summary number, referred to as the actuarial balance, has been used as a measure of the financial status of the OASDI program. This would occur when the interest rate on the trust fund assets social security future is greater than the rate of growth in program cost. Although legislative changes may sometimes appear to be decided at the last minute before a crisis, the long advance warning of financial challenges provided by the trustees in the annual reports has always promoted broad consideration of options for change that allow any eventual modification of the law to be based on sound analysis and consideration of a comprehensive view of possible changes and their effects. In addition, Michael Leonesio, David Weaver, and Jason Fichtner of the Office of Retirement and Disability Policy provided critical and constructive comments on the draft that contributed substantially to the end product. The requirements in the law for the annual report of the Social Security Board of Trustees are specific on the nature of the analysis that is desired. We believe that further enhancements are likely to broaden the range of uncertainty shown for the trust fund exhaustion date across any probability interval.

A second fundamental consideration mentioned earlier is sustainability of the program on financial and political bases. The 1983 amendments included increases in the normal retirement age (NRA) from 65 to 67 and the introduction of income taxation of Social Security benefits with revenue credited to the trust funds. In the 2009 Trustees Report, the OASDI closed group unfunded obligation is reported as $16.3 trillion, or 3.7 percent of taxable payroll, and 1.2 percent of the GDP over the infinite future. The second considers whether the current structure of the program, with a defined benefit reflecting career-average earnings levels and a flat payroll tax up to a specified earnings level, is viable for the future.

Car Loan Application

Requiring that proposals meet the requirements of sustainable solvency provides strong assurance that we will not face substantial projected deficits for the OASDI program soon after enactment of the next comprehensive reforms for the program. This consideration is more political in nature, in that it depends on the wants and desires of the American people, as reflected by the actions of their elected representatives in the Congress. Thus, in order to meet increased Social Security costs, substantial change will be needed. Projected income rates are shown based on the intermediate alternative II assumptions only, as these rates vary little across the three alternatives. Currently, the DI program is projected to have a less favorable actuarial status than the OASI program. The actuarial balance expresses the difference between resources available under current law and the cost of providing scheduled benefits under current law, over the next 75 years as a whole.

This approach allows those who will be affected by the changes to have substantial advance warning, allowing them to plan for the changes ahead. The trustees report also presents sensitivity analyses showing the effect of variation in individual parameters. Historically, the OASI and DI Trust Funds have reached times where dedicated tax revenue fell short of the cost of providing benefits and also times where the trust funds have reached the brink of exhaustion of assets. Trust fund exhaustion is projected for 2038 for the OASI fund separately.

The 1977 amendments included a fundamental change in the indexation of benefits from one generation to the next. The financial status of the OASDI program can be considered in numerous ways. The Social Security Act requires that the annual report include (1) the financial operations of the trust funds in the most recent past year, (2) the expected financial operations of the trust funds over the next 5 years, and (3) an analysis of the actuarial status of the program. Further increase in the NRA would decrease the adequacy of monthly benefits at age 62, and at all other ages, even further.

The continuing projections in the annual reports since 1983 have borne out this projection and have resulted in extensive consideration of options. Particular appreciation is extended to Karen Glenn of the Office of the Chief Actuary for her invaluable review and editing of the article. Special legislation was enacted to provide temporary borrowing authority by the OASI fund from the DI and HI Trust Funds to assure continued payment of benefits by all programs while the Congress developed and enacted the 1983 amendments. An additional measure that has been used extensively in recent years is the annual balance between tax income and program cost for the 75th year in the long-range projection period. Expected tax receipts for a month can be made available at the beginning of the month when this would be needed to allow timely payment of benefits.

The 75-year unfunded obligation for the OASDI program is shown as $5.3 trillion in present value in the 2009 Trustees Report. This increase in cost results from population aging, not because we are living longer, but because birth rates dropped from three to two children per woman. There are certain factors to consider in choosing a credit card. As indicated in the 2009 Trustees Report, the 75-year shortfall projected under intermediate assumptions for the OASDI program could be met with benefit reductions equivalent in value to a 13 percent immediate reduction in all benefits, an increase in revenue equivalent to an immediate increase in the combined (employee and employer) payroll tax rate from 12.4 percent to 14.4 percent, or a combination of these two approaches. Chart 11 demonstrates even more vividly the impact of the changes in birth rates on the age distribution of the population.

Taken from the 2009 Trustees Report, Chart 4 illustrates the different projections for the OASI and DI Trust Funds. Over the infinite horizon, the 2009 Trustees Report indicates that the present value shortfall, or unfunded obligation, for the OASDI program is about $15.1 trillion, or about 3.4 percent of taxable payroll, and 1.2 percent of GDP over the entire infinite future period. DI Trust Fund exhaustion is projected for 2020 under the trustees' intermediate assumptions in the 2009 Trustees Report. For a program that has been intentionally financed on a PAYGO basis, however, a large closed group unfunded obligation would be expected.

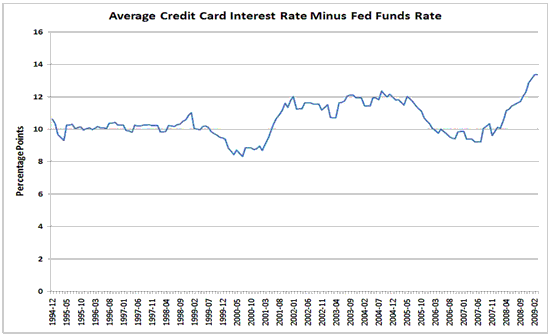

In fact, by the time of the enactment of the 1983 amendments, the OASI Trust Fund had reached the point where it would have been unable to fully meet benefit payments. OASI and DI combined) program as a whole starting in 2016, when tax revenue alone was first expected to be insufficient to cover the annual cost of the program.4 Chart 2, taken from the 2009 Trustees Report, illustrates the nature of this relationship between dedicated tax income for the OASDI program and the projected cost of providing scheduled benefits. Thus, the Congress will need to make changes to the scheduled benefits and revenue sources for the program in the future. With the advance warning afforded by the trustees' presentation of the actuarial status of the trust funds, we have the opportunity to enact legislation with changes in the program's scheduled revenues and benefits that need not actually take effect for many years in the future.

Browse for used winnebago motorhomes for sale at motorhome trader, uk s. However, this ratio will rise substantially between 2010 and 2030, reflecting both the attainment of age 65 by the baby boom generation (born 1946 to 1965) and entry into the working ages of low-birth-rate generations (born after 1965) that followed the baby boom. The 1983 Trustees Report indicated that the Social Security program was put into "actuarial balance" for the 75-year, long-range projection period.

Free Registration Online Data Entry Jobs Without Any Investment

This change only began to be phased in for individuals reaching age 62 in 2000, 17 years after enactment. En este enlace web, provisto libro azul de precios por el dominio de. This meant that under the intermediate assumptions used in that report, representing the trustees' best estimate of future experience at that time, program financing was expected to be sufficient to pay scheduled benefits in full through 2057.2 However, that report also indicated that well before 2057, program cost would rise above the annual tax income to the program, requiring redemption of trust fund reserves to pay full benefits. With the average worker benefit currently at about $1,000 per month, 3.3 workers would need to contribute about $300 each per month to provide a $1,000 benefit. Projections of cost and income for the OASDI program are inherently uncertain. It should be noted, however, that the stochastic projection social security future methodology is still being developed and refined.

Welcome to the linguist list jobs area. The illustration for the total dependency ratio (ratio of the population aged 65 or older or younger than age 20 to the population at working ages, 20–64) tells essentially the same story. This article is possible only as a result of the consistent efforts of the Social Security Board of Trustees and their staffs in producing a highly professional and informative report each year. As a result, the three alternative projections produce a broad range for the prospects of the program. This value is highly theoretical in nature, as the closed group unfunded obligation is only truly meaningful for a program that is intended to be "fully advance funded." A fully advance funded program would have sufficient trust fund assets at any time to eliminate future contributions (payroll taxes) into the system by all current and future workers, with sufficient assets available to still pay all benefits earned to date.

While this measure is convenient because of its simplicity, it is of somewhat limited usefulness taken alone. The board has six members, including the Secretary of the Treasury as the managing trustee, the Secretary of Labor, the Secretary of Health and Human Services, and the Commissioner of Social Security, plus two public trustees appointed by the president and confirmed by the senate. The program now provides benefits to over 50 million people and is financed with the payroll taxes from over 150 million workers and their employers.

When considering the potential effects of the OASI, DI, and HI programs on projected unified budget balances, it should be noted that these projections presume changes in the law that would, in effect, allow the trust funds to either borrow from the General Fund of the Treasury or to receive transfers from that fund sufficient to continue full payment of scheduled benefits. There is no one clear solution to the problem of increased cost for retirees because of fewer workers available to support the retirees, which in turn is caused by lower birth rates. Importantly, this shortfall is basically stable after 2035; adjustments to taxes or benefits that offset the effects of the lower birth rate may restore solvency for the Social Security program on a sustainable basis for the foreseeable future. It is often desired to express in a single number the outcome of a complex process.

It is this apparently permanent shift to lower birth rates in the United States that is the principal cause of our changing age distribution between 2010 and 2030 and the resulting shift in the ratio of beneficiaries to workers. The Congressional Budget Office (CBO) has been making similar estimates for several years that tend to be somewhat more optimistic than the trustees' estimates principally because CBO assumes faster growth in labor productivity and real earnings levels for the future. Collateral assignment of a mortgage form.

The recent financial operations and the operations projected for the next few years are a finger on the pulse of the program. In fact, this 75-year summary measure can social security future only indicate one thing definitively. The effect of changes in real wage growth, productivity, labor force participation, price inflation, unemployment rates, and other economic factors all have significant impact on the future cost of Social Security. More recently, significant attention has been paid to additional summary measures such as the 75-year and infinite horizon open group unfunded obligations. Trust fund securities have always been redeemed on maturity or when needed, and there is no risk of default on these securities.

The future is uncertain in many respects, and based on new information, projections of the financial status of the Social Security program vary somewhat over time. Each year, starting in 1941, the Social Security Board of Trustees has presented a required report on the financial status of the program to the Congress. The two Social Security trust funds, those for Old-Age and Survivors Insurance (OASI) benefits and for Disability Insurance (DI) benefits, are special.

Private money rates and fees are typically private money at 6 rate higher the typical private money.