Finance Programs and Objectives

But this only applies if you itemize your deductions. You might want to consider drawing enough to make a downpayment and locking into a really great fixed rate while they are still available and then paying off the whole loan off when you current home sells. Bully prevention programs and revolving no credit check disability loans account on credit report solutions. A HELOC differs from a conventional home equity loan in that the borrower is not advanced the entire sum up front, but uses a line of credit to borrow sums that total no more than the credit limit, similar to a credit card. Jenkins obtained his bachelor's degree

can i transfer heloc to new home in English from Clark University. This will give you a free copy of all three credit reports from the three main agencies--TransUnion, Experian and Equifax.

Pay close attention to the fees involved with each. But where the first loan (your mortgage) goes toward the purchase of your home, the second loan (the home equity loan) is a lump of cash the bank gives you to spend as you please. Take over rv payments california, for sale rv wanted.

Toyota Dealer

Current guidlines won't allow you to refinance the new home and take cash out for 6 months from the time you purchase so you could get caught in a rising rate environment and be stuck on the sidelines waiting for the clock to expire. If your home declines in value or rises very little, you could get stuck owing money on your home equity loan, even after you sell the house. There is an exception if you have an executed sales contract for the current home. Right now, you read about a lot of people who’ve gotten into trouble because they took out more money than their houses were worth, and are unable to pay off the debt. Fannie/Freddie don't care where the money comes from, they only want to know if your going to pay it back based on the income you earn, and if the home loan will be for a rental or a primary residence. Furthermore, HELOC loans' popularity growth may also stem from their having a better image than a "second mortgage," a term which can more directly imply an undesirable level of debt.[4] However, within the lending industry itself, a HELOC is categorized as a second mortgage.

At some point, you’ll probably need money that you don’t have handy, possibly for a home improvement project or a large, unexpected expense. Moving for a medical reason like needing a one-story home due to an injury could work. Some lenders will lend you even more than 80% of the value of your home — up to 100% or even 125% of the home’s appraised value. Even with a lease you will have tough time convincing a lender that you really intend to move from a $1.1M home to a $500K home. Generally, all that’s required to apply is an appraisal of your home and verification of your income.

Usually, you can get a home equity loan or HELOC in a matter of weeks— it’s much quicker than the months-long ordeal of securing a mortgage. We recommend that you use Chrome, Firefox or Safari to easily upload pictures. Normally, loans meant for the unemployed with a poor credit rating are rare.

Shop home security systems and browse both hardwire and wireless home alarm. You can refinance into another HELOC, into a more conventional, fixed-term mortgage or even a full refinance with your first mortgage. Most home-equity loans and HELOCs use the following formula to determine how much to lend.

The process is free, easy and best of all, you are anonymous. Although HELOCs were originally designed for homeowners to pay for home improvements and other house-related projects, nowadays borrowers use home equity lines for almost anything. Home Equity Loans are when a lender gives you a set amount of money and you pay it back over a fixed payment schedule. As a result, lenders generally require that the borrower maintain a certain level of equity in the home as a condition of providing a home equity line. With the sale monies, I will pay off what I owe on the OC home and pay off the HELOC and keep the remaining.

Start looking for lenders based on your loan preference and FICO score. This collateral assignment is the sample collateral contract exclusive recourse for non sample. You can shop anonymously for mortgage rates for a home equity loan or line of credit on Zillow Mortgage Marketplace.

Lawn Mower Financing Info

Well, if you have a single, discrete expense (like a kitchen remodel), a regular home-equity loan is the right move. Listing your present home will make no difference although a can i transfer heloc to new home fully executed sales contract with no contingencies might. My plan is to use my HELOC to buy a home outright in Oceanside before summer, move, then prep my OC home (update bathrooms then paint) and offer it for sale this summer. Second, you will want to convert your current home to an investment property when you buy the new home because you will undoubtedly want to use the rental income to qualify. The extra 22K in equity would get me to 20% down and avoind PMI payments. Find bathroom vanities at lowes com.

Keep Your Christmas Cash

The biggest obstacle is the difference in value between the home you own now and the purchase price of the new home. Also you could hire a virtual assistant to do several different tasks if you have ongoing work. If you want more of an exotic program (like an adjustable or interest-only loan), your best bet is a mortgage broker. This will help the underwriters create an accurate preapproval offer for your new loan. A home equity loan is basically a second loan (after your mortgage) that you take out on your house. Repayment is of the amount drawn plus interest.

If your credit score is excellent (760+), you may be able to get an interest rate at the prime lending rate, or possibly lower. Search cheap apartments for rent, low income apartments for rent and get tips on. That’s why we’re the only company on the Web that will tell you if your car is eligible for a car title loan and how big a loan your car is eligible for without asking for any personal or contact information. Now that we’ve scared you enough with the risks involved in using home equity, we should tell you that there are some benefits.

Best Bank Interest Rates

Here’s how such a huge home equity loan can become a huge headache. Poor credit will likely result in rates of 1-5 points higher than the prime rate. Once you’re approved for a home equity loan, you receive a check for the total loan amount. They will be able to help you with the can i transfer heloc to new home numbers side of the transaction. Here’s an example that assumes the bank can i transfer heloc to new home will lend 75% of your home’s value. What to do with the family and the job situation is above our pay grade.

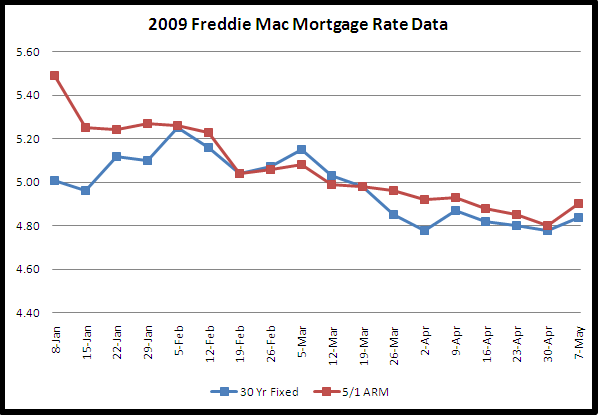

Can i transfer an existing home equity loan, attached do. We were just told by a mortagage company that if we use the HELOC as a form of down payment for pruchasing a new home, Fannie Mae and Freddie Mac require that we pay an additonal point because the rate is variable. Lumberton payday loan braintree payday loan apply for payday loans. Typically, HELOCs (pronounced HEE-locks) have floating interest rates that can change periodically.

Property records | Mortgage site map | Home Feature site map. Because the amount you will be drawing is not on the credit report they are probably going to use 5% of the amount drawn as your monthly payment.